With stock and bond markets both faltering over the past year, it’s easy to see why more near-retirees have a newfound appreciation for fixed annuities — insurance contracts that guarantee a specified rate of return. A fixed annuity maintains its value regardless of market conditions, and yields on these products have risen in response to the higher interest-rate environment.

When you purchase a fixed annuity, you are shifting the risk for future investment returns to the insurance company. It’s also a way to create a pension-like income stream for retirement, starting right away or when you are older.

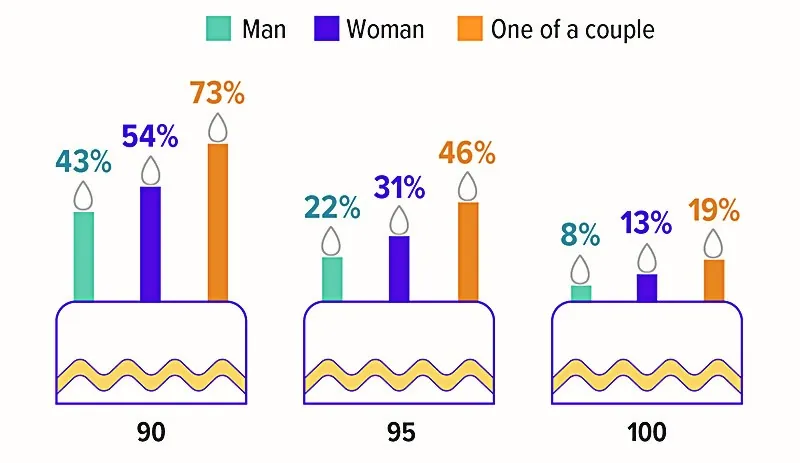

A Long Retirement

Probability that a healthy 65-year-old will live to the following ages:

Income for Now or Later

An immediate fixed annuity is usually purchased at the beginning of retirement, often with a lump-sum premium. The fixed payments start within 12 months from the date the annuity is purchased and continue for the duration of the contract.

With a deferred fixed annuity, you can make a series of premium payments, and the income is delayed until a future date of your choosing. This type of annuity can be used to save for retirement or to provide income in your later years. The income payments reflect the value of the premiums paid, the annuity’s compounded return, and the length of the payout period (or your life expectancy). Thus, the longer you defer your annuity, the higher the payout can be.

Unlike tax-advantaged workplace plans and IRAs, annuities have no annual contribution limits, so they present an opportunity to save as much as you want on a tax-deferred basis. When annuities are purchased with after-tax dollars, only the earnings portion of withdrawals is taxable as ordinary income. You can also invest in an annuity through a qualified (tax-advantaged) retirement plan. In this case, the qualified annuity is subject to the same tax rules as the qualified plan, so there is no additional tax benefit. For both qualified and nonqualified annuities, early withdrawals prior to age 59½ may be subject to a 10% penalty.

Annuitization Options

Converting the funds in an annuity to an income stream is called annuitization. A deferred annuity contract will specify the date at which you can annuitize and begin to receive payments as defined in the contract, but generally you are not required to do so at that time. Although a guaranteed income is often a sought-after feature of annuities, many owners choose not to annuitize.

Before annuitization, you can withdraw some or all of the annuity funds in a lump sum or a series of distributions. However, surrender charges typically apply if you withdraw more than a specified amount before the end of the surrender period. If you die before annuitizing, your heirs would receive the funds accumulated in the annuity. After you annuitize, you no longer control the funds, so you cannot take lump-sum distributions.

Whether you purchase an immediate or deferred fixed annuity, you’ll have options for the income stream you will receive during the annuitization period. A straight, guaranteed lifetime income will provide the highest monthly payments and help protect against the risk of outliving your savings. But payments will typically end when you die, with no funds going to your heirs. A “period certain” provides income for a fixed number of years and will go to your heirs if you die before the end of the period, but you risk running out of income if you live beyond the period. “Life with a period certain” guarantees you a lifetime income along with a period of time in which it can pass to your heirs, but payments are generally lower.

The decision to annuitize — and the option you choose if you decide to do so — will depend on your financial situation, life expectancy, and risk tolerance.

Annuities have contract limitations, fees, and expenses, and they are not appropriate for every investor. Withdrawals reduce annuity benefits and values. Any guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company. Investors should be aware that when they purchase a fixed annuity, they may sacrifice the opportunity for higher returns that might be available in the financial markets, and that inflation could reduce the future purchasing power of their annuity payouts. Annuities are not guaranteed by the FDIC or any other government agency. They are not deposits of, nor are they guaranteed or endorsed by, any bank or savings association.