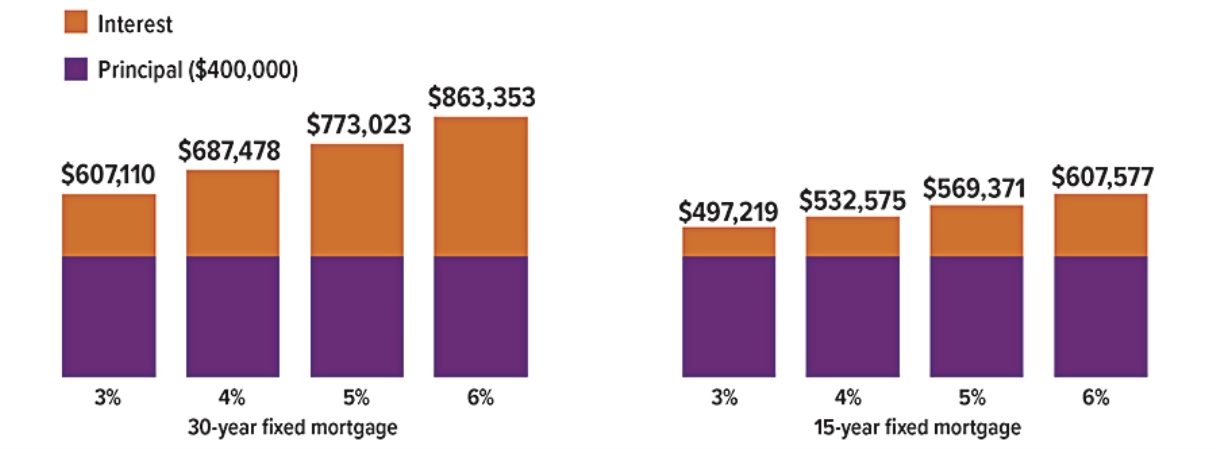

In April 2022, the average interest rate for a 30-year fixed mortgage surpassed 5% for the first time since April 2010, and it was still above 5% in August. With higher rates, it’s more important than ever to understand how interest increases the total cost of a mortgage.

The chart below shows the total cost for a $400,000 conventional 30-year fixed mortgage and an accelerated 15-year fixed mortgage (typically used for refinancing) at different interest rates. A $400,000 mortgage would enable a buyer to purchase a $500,000 home with a 20% down payment.

Source: Freddie Mac, 2022. This hypothetical example of mathematical principles is used for illustrative purposes only. Actual results will vary.

5.12 million

Existing home sales in June 2022, down 14.2% from June 2021. Rising mortgage rates and general inflation have cut into purchasing power for homebuyers, while the national median existing-home price reached a record $416,000, up 13.4% from one year ago. A recent increase in homes on the market may help to ease prices, but that remains to be seen.

Source: National Association of Realtors, 2022

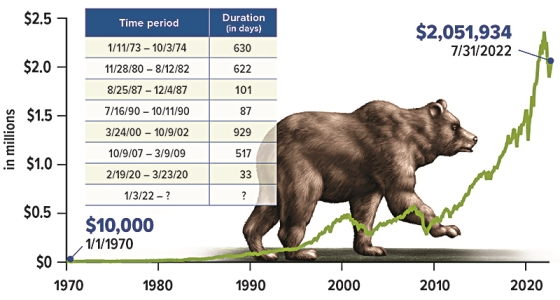

Retirement Savings in a Volatile Market

If you worry about your retirement investments duringmarket downturns, you’re not alone. Unfortunately,emotions are often the enemy of sound investing. Hereare some points to help you stay clear-headed duringperiods of market volatility.

Markets Rebound

Historically, even the worst bear market has bouncedback and eventually gone on to reach new highs. Infact, since 1970, bear markets have lasted an averageof 14 months.

A Chance to Buy Low

If you’re investing a set amount of money on a regularbasis, such as in a retirement plan account, you’rebuying fewer shares when prices are high and moreshares when prices are low — one of the basic tenets ofinvesting wisely.

Systematic investing involves making continuousinvestments on a regular basis, regardless offluctuating share prices. Although this strategy doesnot ensure a profit or prevent a loss, you must befinancially able to continue making purchases throughextended periods of high and low price levels.

Retiree Strategies

The risk of experiencing poor investment returns justbefore or in the early years of retirement is asignificant factor that can affect a nest egg’s long-termsustainability. Fortunately, some strategies can helpmitigate this risk.

For example, consider a tiered investment strategy, inwhich you divide your portfolio into tiers representingyour short-, medium-, and long-term needs for incomeand growth.

The short-term tier(s) could contain the amount youneed for about two to five years, invested in assetsdesigned to preserve value. The medium-term tier(s)could hold investments that strive to provide incomefor perhaps three to 10 years, balanced with somegrowth potential. The longer-term tier(s) could holdhigher-risk, higher-growth potential assets that youwouldn’t need for at least 10 years. Generally, this tieris intended to feed the shorter-term tiers and fuel thestrategy over the course of your retirement.

Another possible strategy is using a portion of yourretirement savings to purchase an immediate annuity,which offers a predictable retirement income streamyou could pair with Social Security and any othersteady income sources to cover your fixed expenses.

An immediate annuity is an insurance-based contractin which you pay the issuer a single lump sum inexchange for the issuer’s guarantee of regular incomepayments for a fixed period or the rest of your life. Withsome exceptions, you typically receive fixed paymentswith little or no variation in the amount or timing. Whenpurchasing an immediate annuity, you relinquishcontrol over the amount you invest.

A Financial Professional Can Help

If volatile markets prompt you to question yourretirement investing strategy, your financialprofessional can be an objective third party to helpease your worries and evaluate possible portfolioshifts.

Bear Markets Eventually End

A bear market is generally defined as a loss of at least 20% from a recent high. From 1970 to 2021, there were sevenbear markets, the longest lasting less than three years. Anew bear market began in January 2022. Despite thesedown periods, a hypothetical $10,000 investment in the S&P500 in 1970 would have grown to more than $2 million by 2022.

Source: S&P Dow Jones Indices and Refinitiv, 2022, for the period 1/1/1970 to 7/31/2022. The S&P 500 is an unmanaged index that is considered to be representative of the U.S. stock market. The performance of an unmanaged index is not indicative of any specific investment.Individuals cannot invest directly in an index. Past performance is not aguarantee of future results. Actual results will vary.

All investments are subject to market fluctuation, risk, and loss of principal. Shares, when sold, may be worth more or less than their original cost.Investments seeking to achieve higher returns also involve a higher degreeof risk. There is no assurance that working with a financial professional willimprove investment results.

Generally, annuity contracts have fees and expenses, limitations,exclusions, holding periods, termination provisions, and terms for keepingthe annuity in force. Most annuities have surrender charges that areassessed if the contract owner surrenders the annuity. Withdrawals ofannuity earnings are taxed as ordinary income. Withdrawals prior to age59½ may be subject to a 10% penalty. Any annuity guarantees arecontingent on the financial strength and claimspaying ability of the issuinginsurance company.

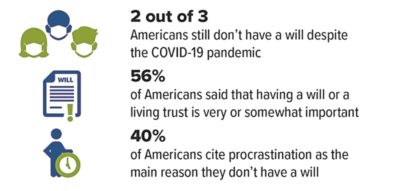

Famous People Who Died Without Proper Planning

The importance of proper estate planning cannot beoverstated, regardless of the size of your estate or thestage of life you’re in. Nevertheless, it’s surprising howmany American adults haven’t put a plan in place.You might think that those who are rich and famouswould be way ahead of the curve when it comes toplanning their estates properly. Yet plenty of celebritiesand people of note have died with inadequate ornonexistent estate plans.

Michael Jackson

The king of pop died in June 2009 with an estate worthan estimated $600 million. Jackson had prepared anestate plan that included a trust. However, he failed tofund the trust with assets prior to his death — a commonmisstep when including a trust as part of an estateplan. While a properly created and funded trustgenerally avoids probate, an unfunded trust almostalways requires probate. In this case, Jackson’s trustbeneficiaries had to make numerous filings with theprobate court in order to have the judge transferassets to the trust. This process added significantcosts and delays, and made what should have been aprivate matter open to the public.

Trusts incur upfront costs and often have ongoingadministrative fees. The use of trusts involves acomplex web of tax rules and regulations. You shouldconsider the counsel of an experienced estateplanning professional and your legal and taxprofessionals before implementing such strategies.

James Gandolfini

When the famous Sopranos actor died in 2013, hisestate was worth an estimated $70 million. He had awill, which provided for various members of his family.However, his estate plan did not include proper taxplanning. As a result, the Gandolfini estate ended uppaying federal and state estate taxes at a rate of 55%.This situation illustrates that a carefully crafted estateplan addresses more than just the distribution ofassets. Taxes and other expenses could be reduced, ifnot eliminated altogether, with proper planning.

Prince

Prince Rogers Nelson, better known as Prince, died in2016. He was 57 years old, still making incrediblemusic, and entertaining millions of fans throughout theworld. The first filing in the Probate Court for CarverCounty, Minnesota, was by a woman claiming to behis sister, asking the court to appoint a specialadministrator because no will or other testamentarydocuments were filed. Since Prince died without a will,the distribution of his over $150 million estate wasdetermined by state law. In this case, a Minnesotajudge was tasked with culling through hundreds ofcourt filings from prospective heirs, creditors, andother “interested parties.” The proceeding was openand available to the public for scrutiny.

Barry White

Barry White, the deep-voiced soulful singer, died in2003 without a will or estate plan. He died while legallymarried, although he’d been separated from hissecond wife for many years and was living with along-time girlfriend. He had nine children. Because hehad not divorced his wife, she inherited everything,leaving nothing for his girlfriend or his children.Needless to say, a legal battle ensued.

Heath Ledger

Formulating and executing an estate plan is important.It’s equally important to review your documentsperiodically to be sure they’re up-to-date. Not doing socould result in problems like those that befell theestate of actor Heath Ledger. Although Ledger hadprepared a will years before his death, severalchanges in his life transpired after the will was written,not the least of which was his relationship with actressMichelle Williams and the birth of their daughterMatilda Rose. The will left nothing to Michelle orMatilda Rose. Fortunately, Ledger’s family later gaveall the money to his daughter, but not without somefamily disharmony.

Florence Griffith

JoynerAn updated estate plan works only if the peopleresponsible for carrying out your wishes know whereto find these important documents. When Olympicmedalist Florence Griffith Joyner died in 1998 at theyoung age of 38, her family couldn’t locate her will.This led to a bitter dispute between her husband, AlJoyner, and Flo Jo’s mother, who claimed herdaughter had promised that she could live in theJoyner home for the rest of her life.

Americans Are Putting Off Estate Planning

Source: 2022 Wills and Estate Planning Study, Caring.com

FAFSA Opens on October 1

The Free Application for Federal Student Aid (FAFSA)for the 2023-2024 school year opens on October 1,2022. Here are some things you should know.

Why file it? The FAFSA is a prerequisite for federalstudent loans, grants, and work-study. In addition,colleges typically require the FAFSA before distributingtheir own need-based aid and, in some cases,merit-based aid. The few hours it might take tocomplete the form may be time well spent in order forstudents to be eligible for these aid opportunities.

How do I file it? The best way to submit the FAFSA isonline at studentaid.gov. If you haven’t filed the FAFSAbefore, both you and your child need to create an FSAID (you can use the same FSA ID for all years ofcollege). Students must file the FAFSA each year,though returning college students can file a renewalFAFSA, which should take less time.

How does the FAFSA calculate financial need? Financial need is determined by looking at a family’sincome, assets, and household information. In general,here’s how the calculation works: (1) parent income iscounted up to 47% (income equals adjusted grossincome plus untaxed income/benefits minus certaindeductions); (2) student income is counted at 50%over a certain amount; (3) parent assets are countedat 5.6% (home equity, retirement assets, cash valuelife insurance, and annuities are excluded); and (4)student assets are counted at 20%.

In this calculation, a family’s income is the mostimportant factor. But the FAFSA doesn’t consider yourcurrent income. Instead, it considers your income fromtwo years prior, which it gets from your tax return. Forexample, the FAFSA for the 2023-2024 year will relyon income information from your 2021 tax return. Foryour assets, the FAFSA wants the current value ofyour assets as of the day you fill out the form.

What happens after I submit the FAFSA? TheFAFSA calculates your expected family contribution, orEFC. The cost of a particular college minus your EFCequals your child’s demonstrated financial need.Colleges will use your EFC to craft an aid package thatattempts to meet your child’s financial need (they arenot obligated to meet all of it).

Changes are coming. More changes are coming tothe 2024-2025 FAFSA, a year later than originallyplanned. Key modifications include (1) a change interminology from “expected family contribution” or EFCto “student aid index” or SAI; (2) parents with multiplechildren in college at the same time will no longerreceive a discount in the form of a reduced EFC; (3)income protection allowances for both parents andstudents will be increased; and (4) cash support tostudents and other types of income will no longer haveto be reported on the FAFSA, including funds from agrandparent-owned 529 plan.1) U.S. Department of Education, 2022